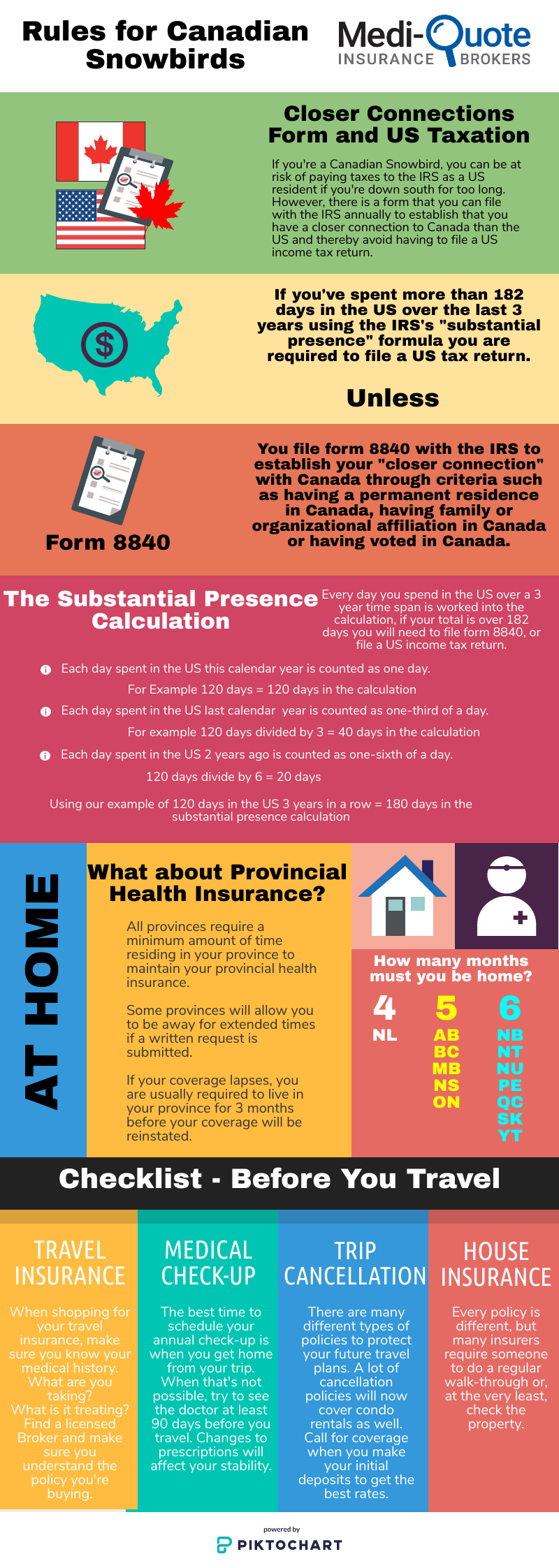

If you’re a Canadian Snowbird, you should be aware of the closer connections requirement for Canadians travelling to the US, as you can be at risk of being required to pay taxes to the IRS as a US resident if you’re down south too long. However, there is a form that you can file with the IRS annually to establish that you have a closer connection to Canada than the US and thereby avoid having to file a US income tax return.

If you’ve spent more than 182 days in the US over the last 3 years you are required by the IRS to file a US tax return.

Unless:

You file form 8840 with the IRS to establish your “closer connection” with Canada through criteria such as having permanent residence in Canada, having a family or organizational affiliation in Canada, or having voted in Canada.

What about Provincial Health Insurance?

All provinces require a minimum amount of time residing in your province to maintain your provincial health insurance coverage. Some provinces will allow you to be away for extended times if a written request is submitted. If your coverage lapses, you are usually required to live in your province for 3 months before your coverage will be reinstated.

Some of the consequences of being outside Canada, or in the US, for too long:

- US Travel Bans – If found to be unlawfully present in the US between 183 and 365 days, you could face a 3-year travel ban. If found to be unlawfully present in the US for more than 365 days, you could face a 10-year travel ban.

- Liability for U.S. income tax on worldwide income – If present inside the US for too long, you could become subject to US tax laws, and be taxed on your worldwide income.

- Liability of U.S. estate tax on the fair market value of worldwide assets – Once subject to US tax laws, a person who dies in the US would have their estate taxed based on the value of their worldwide assets.

- Liability of Canadian departure tax – A Canadian who is no longer a resident may be subject to a Canadian departure tax. This means once you lose your Canadian resident status, you would be deemed to have disposed of your assets, and pay tax on the gains.

- Loss of provincial healthcare coverage – Once a Canadian is no longer a resident of a particular province, they lose the right to provincial healthcare coverage. The rules governing residency are different than those covered by previously mentioned tax laws. Consult your provincial healthcare body for specific rules and exceptions.

Disclaimer: Refer with the Internal Revenue Service (IRS) for official forms and rules when making decisions. You can also consult tax professionals in Canada for advice. We are insurance experts, not tax experts. The information available on this page is the best we’ve been able to find so far, and we hope you find it useful.

The infographic below will help you understand the closer connections requirement for Canadians travelling to the US.

To speak to a licensed travel insurance broker about travel insurance for long stays in the US, call us at 1-800-661-3098.